Description

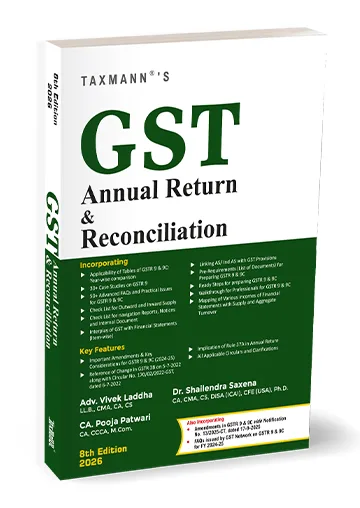

GST Annual Return & Reconciliation stands as a complete professional reference for understanding and implementing the Annual Return (GSTR-9) and Reconciliation Statement (GSTR-9C) under India’s GST law. Updated with all amendments as per Notification No. 13/2025-CT dated 17th September 2025, this book provides a comprehensive integration of law, accounting, audit, and procedural practice, enabling tax professionals and businesses to achieve accuracy, compliance, and audit readiness in their annual filings. The authors—experienced practitioners and academicians—position this book as a 360° exploration of GST finalisation. It moves beyond form instructions to provide analytical interpretation, illustrative reconciliations, and practical strategies that connect financial statements with GST disclosures, bridging the gap between accounting data and statutory compliance.

This book is an essential resource for:

Chartered Accountants, Cost Accountants, Company Secretaries, and GST Practitioners engaged in annual return preparation, audit, and reconciliations

CFOs, Tax Heads, and Finance Controllers of companies seeking to ensure accurate reporting and compliance consistency

Tax Officers, Consultants & Litigation Professionals dealing with mismatch issues, notices, and reconciliation disputes

Students, Researchers & Academicians who require a structured, practitioner-based understanding of annual GST compliance

The Present Publication is the 8th Edition | 2026, authored by Adv. Vivek Laddha, Dr Shailendra Saxena, and CA. Pooja Patwari, with the following noteworthy features:

[Covers All Recent Amendments] Incorporating the revised formats and instructions for GSTR-9 & 9C (FY 2024-25)

[Rich Practical Orientation] Over 30 case studies and 50 FAQs addressing reconciliation mismatches, ITC errors, and common filing hurdles

[Pre-filing Readiness Tools] Includes checklists for document collection, outward/inward supply validation, and internal audit mapping

[Financial Linkage Clarity] Demonstrates item-wise mapping between books of account and GST returns, correlating AS/Ind AS with GST provisions

[Comprehensive References] Covers all circulars, clarifications, and Rule 37A implications relevant to the Annual Return

[Step-by-step Filing Methodology] Complete walkthroughs of GSTR-9 & 9C with illustrative formats, tables, and screenshots

[Professional Appendices] Includes model Engagement Letters, Compilation Reports, and Checklists, along with GSTN FAQs and clarifications (2024-25)

The 8th Edition offers a meticulous roadmap through every stage of annual compliance, starting from applicability to professional certification. Key inclusions are:

Bird’s-eye View of Annual Return Preparation Strategies

Applicability thresholds, filing deadlines, composition scheme nuances, and inter-form linkages between GSTR-1, 3B, 9 and 9C

Detailed Amendments & Key Considerations (FY 2024-25)

Changes in GSTR 9/9C tables, introduction of columns, and updated reconciliation methods

Year-wise Applicability Comparison

A visual guide on tables relevant across financial years

Case Studies & Practical Issues

Examples explaining outward supply mismatches, ITC reversals, and turnover anomalies

Financial Statement Integration

Insightful discussion on how to read and interpret financial statements for GST reporting consistency

Advanced FAQs

Addressing niche queries and departmental clarifications with interpretative reasoning

Appendices

Full statutory text of Forms GSTR-9, 9A & 9C; Advisories, Clarifications by GSTN; and model professional reports for compilation and certification

The book follows a progressive structure, guiding readers from conceptual clarity to practical execution:

Preliminary Framework & Legal Foundation – Governing provisions, legal consequences of wrong or delayed filing, and strategic overview of annual return preparation

Hands-on Case Studies – Practical examples of outward supplies, ITC reconciliation, and professional walkthroughs

Financial & Accounting Integration – Bridging GST forms with financial statements, turnover classification, and accounting adjustments

Form-wise Segmentation – Detailed section-by-section commentary on GSTR-9 & 9A, including every table, part, and annexure

Reconciliation Statement – Step-by-step guidance through GSTR-9C—turnover reconciliation, tax payment matching, ITC verification, and reporting of additional liabilities

Appendices – Updated forms, FAQs, advisories, and specimen documentation for professional certification